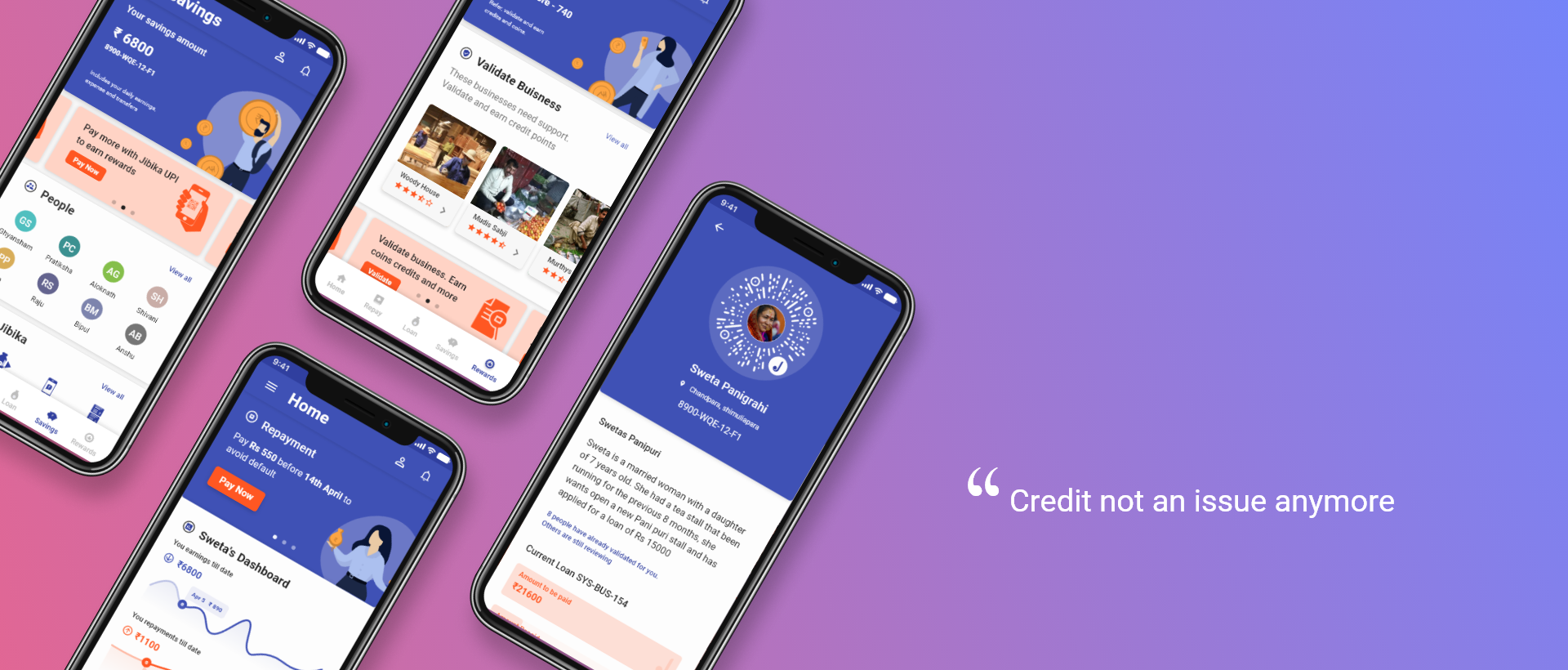

Jibika - A microfinance application that lets you borrow credit in a trustworthy and efficient way.

Course

Design Project - Fourth Semester

Interaction Design | UX Design | UI Design

Duration

4 weeks

Overview

The microfinance sector plays an important role in promoting inclusive growth by providing credit to borrowers at the bottom of the economic pyramid especially for post pandemic economic reforms. The Jibika app is an initiative to make such reforms hassle free and more trust worthy with less defaulters and more financial security.

The Process

Discover

Secondary Research

Primary Research

Deducing Insights

Define

Personas

Deducing opportunity areas

Defining the brief

HMW questions

Develop

Brainstorming

Ideating concepts

Business Model

Design Language

Deliver

High Fidelity Wireframes

Prototyping and testing

Review and feedbacks

Discover

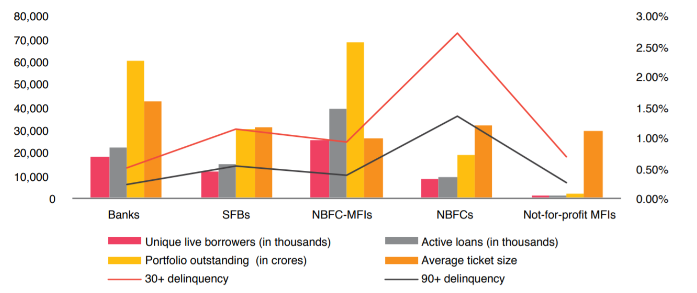

Indian Microfinance Scenario

Potential for growth of microfinance in India

Needs for digital microfinance ecosystem.

Primary Research

Semi-structured interviews were conducted with people having small scale businesses from rural and semi rural areas in and around my area, to have an understanding of the current user experience and behaviors of both existing physical credit systems and MFIs. I also tried to understand if the users understood the digital space and what are there existing financial behaviors.

What people had to say

“ Loans from banks ask for a lot of collateral. I don’t have that much to support my loan”

“Lenders do not trust that I can return the money and make profit myself”

“Return periods for individual lenders is too short. I cant manage in such short time”

“Most loan amounts goes into managing daily needs. Cant even generate a good amount of profit”

“Local MFIs high on security money and processing fees”

“Individual lenders often asks for unrealistic paybacks. ”

Insights

On analyzing the collected data points from the primary and secondary research , I performed an affinity map to derive themes and clustered them to generate working insights

Define

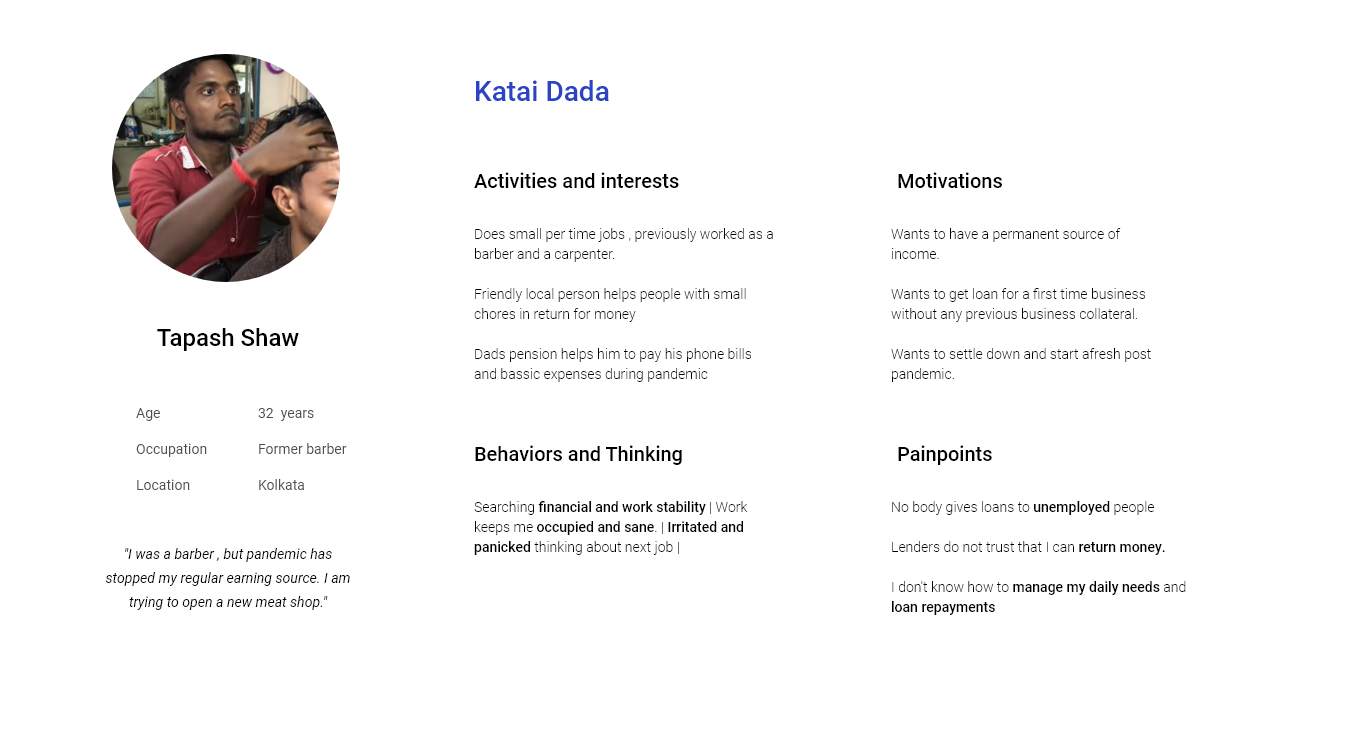

Personas

After analyzing the collected data points from the primary and secondary research and developing the insights I came up with the two personas defining their characteristics, painpoints and motivations

High level goal of users

To trust and use a platform intuitively without fear of defaulting and failing in the process.

To have flexible and personalized repayments , collaterals and profit margins for both borrowers and lenders

To trace misusage and malice in the system and having transparency and accountability for the same.

The Brief

To design an intuitive and trustworthy platform that caters both lenders and borrowers in an micro financial setting with flexible and personalized repayments , collaterals and profit margins.

How Might We

Design

How might we build an intuitive and trustworthy platform

How might we cater values of both lenders and borrowers in a credit oriented system

How might we have personalization and flexibility suiting varied user needs

Financial Model concept

After brainstorming with the how might we , I ideated around what should the financial model would look like suiting the best for all stakeholders

Strategic Financial Model

Introducing Jibika

Jibika is a Bengali word meaning livelihood It stands for daily sustenance and support.

Deliver

Onboarding

Minimal, loud and clear brand message with easy 3 step verification of user authenticating phone number , Adhar and Pan.

On boarding Screens

Jibika Navigation

The navigation revolves around the primary functions to apply for a loan, repay a loan , manage profits and validate others businesses to achieve rewards and extra credit points.

Navigation Screens

Applying for a loan

Minimal, loud and clear brand message with easy 3 step verification of user authenticating phone number , Adhar and Pan.

Loan Application Screens

Validating Others Business

Validating others business helps earn credit points and make your own business proposal have better visibility to lenders. More credit points better visibility , better chances of getting loan sanctioned

Validating Business Screens

Testing and reviews

“If I fail to pay the loan after repeated attempts, is my shop at risk ?”

— Jhontu Mandal | Kirana Shopkeeper

“It is pretty easy , but online if any issues happen whom do I contact”

— Krishanu Barui | Tea Stall